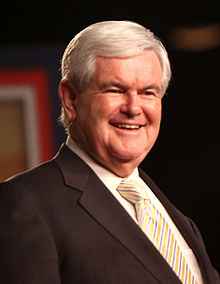

and How Newt Gingrich Abetted the Theft of Average Joe’s Home

and How Newt Gingrich Abetted the Theft of Average Joe’s Home

The untold story in the foreclosure crisis unfolding across America is that, following a foreclosure perpetrated by one of the October 2008 Bailout Banks (e.g. Bank of America, Citibank, JPMorgan, Wells Fargo) Fannie Mae or Freddie Mac suddenly appear as the record owner of Average Joe’s home. These federal government sponsored entities then go into local housing court and get a court order authorizing them to evict Joe. If Joe resists, these supposedly charitable institutions obtain a writ ordering the local sheriff to forcibly remove Joe from his home.

Economic Glance

Economic Glance Treasury Secretary Henry Paulson stepped off the elevator into the Third Avenue offices of hedge fund Eton Park Capital Management LP in Manhattan. It was July 21, 2008, and market fears were mounting. Four months earlier, Bear Stearns Cos. had sold itself for just $10 a share to JPMorgan Chase & Co. (JPM)

Treasury Secretary Henry Paulson stepped off the elevator into the Third Avenue offices of hedge fund Eton Park Capital Management LP in Manhattan. It was July 21, 2008, and market fears were mounting. Four months earlier, Bear Stearns Cos. had sold itself for just $10 a share to JPMorgan Chase & Co. (JPM) We knew the last bailout from the Federal Reserve was pretty big, but not until now did we have statistics on the actually tally. If you thought that the $700 billion bailout for TARP was big, get a load of this.

We knew the last bailout from the Federal Reserve was pretty big, but not until now did we have statistics on the actually tally. If you thought that the $700 billion bailout for TARP was big, get a load of this. The solution is simple. Every country should tell the bankers to take a hike and crash and burn and new currencies should immediately be proffered, based on whatever it is people want to collectively consider valuable. The hoarded excesses of the manipulative and psychopathic overlords, should be wiped out in the interest of returning balance. Iceland should be the guidon and standard behind which all following nations should march. If you don't do it you are basically saying, “Go ahead and destroy me, I deserve it.”

The solution is simple. Every country should tell the bankers to take a hike and crash and burn and new currencies should immediately be proffered, based on whatever it is people want to collectively consider valuable. The hoarded excesses of the manipulative and psychopathic overlords, should be wiped out in the interest of returning balance. Iceland should be the guidon and standard behind which all following nations should march. If you don't do it you are basically saying, “Go ahead and destroy me, I deserve it.” The Federal Reserve and the big banks fought for more than two years to keep details of the largest bailout in U.S. history a secret. Now, the rest of the world can see what it was missing.

The Federal Reserve and the big banks fought for more than two years to keep details of the largest bailout in U.S. history a secret. Now, the rest of the world can see what it was missing. The fact that GE paid no taxes in 2010 was widely reported earlier this year, but the size of its tax return first came to light when House budget committee chairman Paul Ryan (R, Wisc.) made the case for corporate tax reform at a recent townhall meeting. "GE was able to utilize all of these various loopholes, all of these various deductions--it's legal," Ryan said. Nine billion dollars of GE's profits came overseas, outside the jurisdiction of U.S. tax law. GE wasn't taxed on $5 billion in U.S. profits because it utilized numerous deductions and tax credits, including tax breaks for investments in low-income housing, green energy, research and development, as well as depreciation of property.

The fact that GE paid no taxes in 2010 was widely reported earlier this year, but the size of its tax return first came to light when House budget committee chairman Paul Ryan (R, Wisc.) made the case for corporate tax reform at a recent townhall meeting. "GE was able to utilize all of these various loopholes, all of these various deductions--it's legal," Ryan said. Nine billion dollars of GE's profits came overseas, outside the jurisdiction of U.S. tax law. GE wasn't taxed on $5 billion in U.S. profits because it utilized numerous deductions and tax credits, including tax breaks for investments in low-income housing, green energy, research and development, as well as depreciation of property. The Securities and Exchange Commission, which failed to stop Bernard Madoff’s long-running investment fraud despite repeated warnings, has disciplined eight agency employees over their handling of the matter but did not fire anyone, according to a SEC spokesman.

The Securities and Exchange Commission, which failed to stop Bernard Madoff’s long-running investment fraud despite repeated warnings, has disciplined eight agency employees over their handling of the matter but did not fire anyone, according to a SEC spokesman.