US corporations and their supporters in Washington are pushing aggressively to roll back tax policies they once endorsed, in a move that could return hundreds of billions of dollars to some of America’s biggest companies.

As congressional negotiators attempt to keep the government funded past 19 January, an agreement is emerging that ties the corporate tax breaks to an increase in support for vulnerable American families – an effort to make the deal more palatable for Democrats.

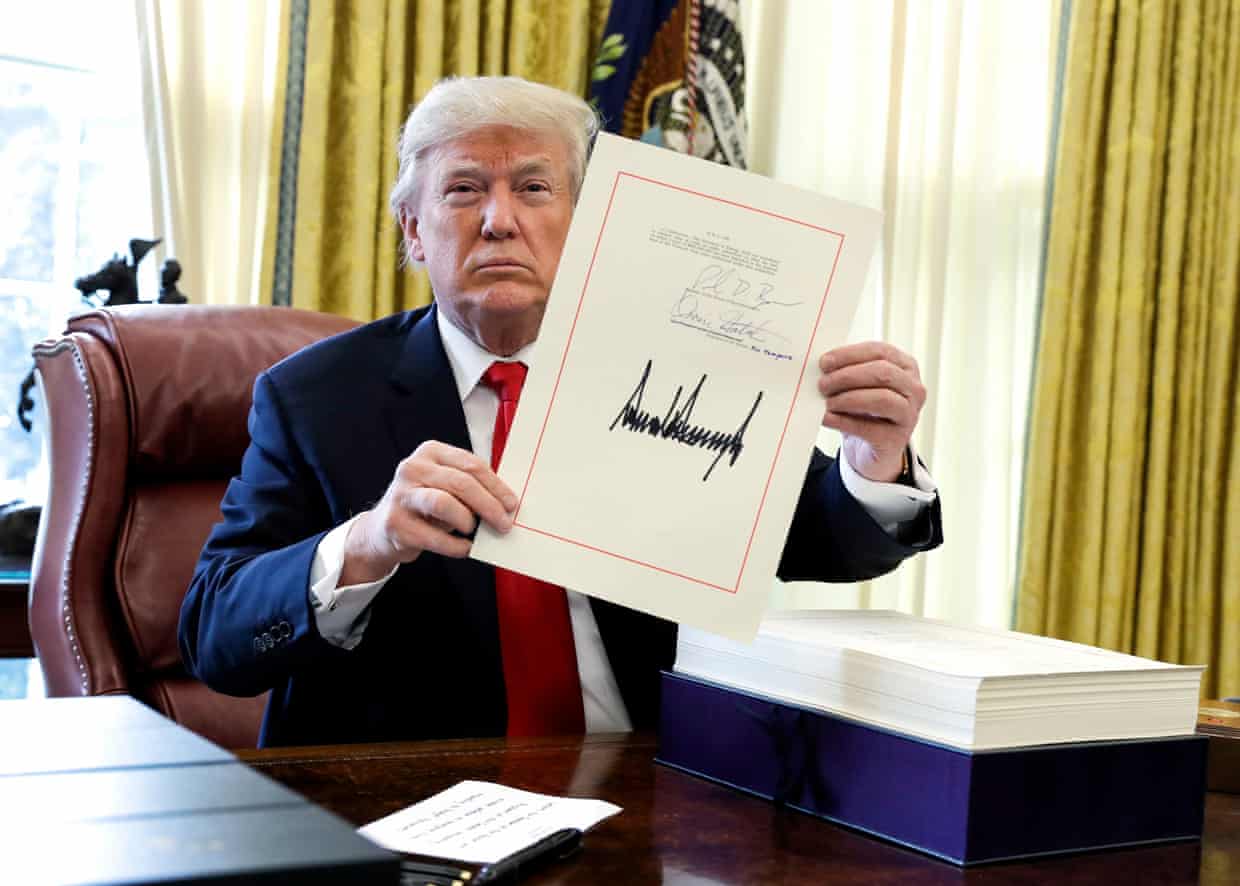

Just six years ago the Business Roundtable, a lobbying group for CEOs of large US firms, described the Trump-era Tax Cuts and Jobs Act as “a remarkable, once-in-a-generation opportunity”. Now, the group is leading “a six-figure advocacy campaign” to roll back parts of it, according to Politico, and threatening that failing to secure new tax cuts will lead to “slower job creation, smaller wage increases and lower overall economic growth”.